what is suta tax california

It also provides for a substantial penalty. It is a tax assessed on employers to fund unemployment benefits.

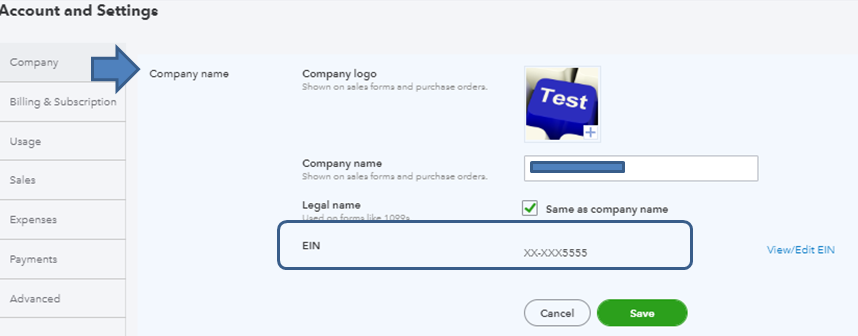

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop Youtube

This new law effective January 1 2005 provides for employers who are caught illegally lowering their UI rates to pay at the highest rate provided by law plus an additional 2 percent.

. In 2018 the trust fund regained a positive balance after nine years of insolvency. On Schedule F there is a 2 tax. What is SUTA.

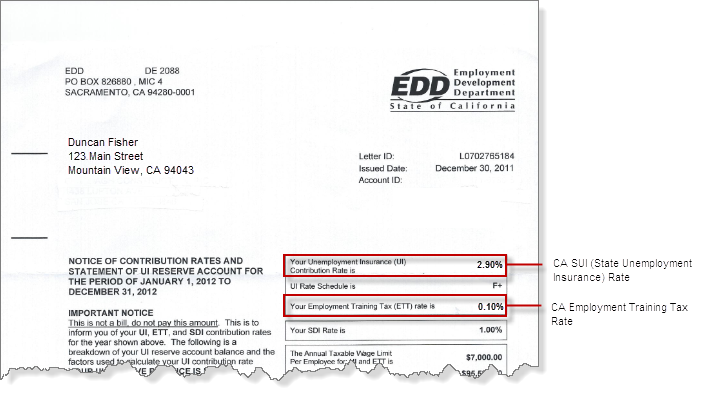

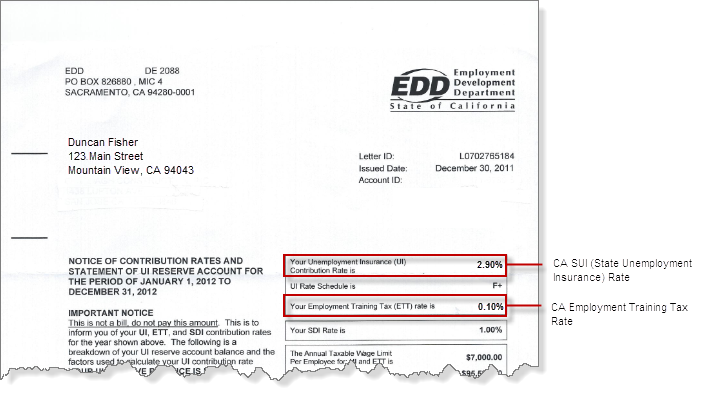

File With Confidence Today. The ETT rate for 2022 is 01 percent. The California law requires employers that are caught illegally lowering their UI rates to pay at the highest rate provided by law plus an additional 2.

52 rows Generally unemployment taxes are employer-only taxes meaning you do not withhold the tax from employee wages. SUTA dumping is also referred to as state unemployment tax avoidance and tax rate manipulation. Employers in California are subject to a SUTA rate between 15 and 62.

The SDI withholding rate for 2022 is 110 percent. What is the state payroll tax in California. The SUTA program was developed in each state in 1939 during the Great Depression when the US.

Answer Simple Questions About Your Life And We Do The Rest. Imagine you own a California business thats been operating for 25 years. What is California tax rate for payroll.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. In 2020 there will be a 4 increase. You cannot protest an SDI rate.

A 1 mental. In California in recent years it has been somewhere around 34. California was one of the first states to enact legislation as a result of the federal SUTA Dumping Prevention Act.

You will pay 1050 in SUI. Experienced sky-high unemployment rates. What is CA sit tax.

For example the wage base limit in California is 7000. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base. The SUI taxable wage base for 2020 remains at 7000 per employee.

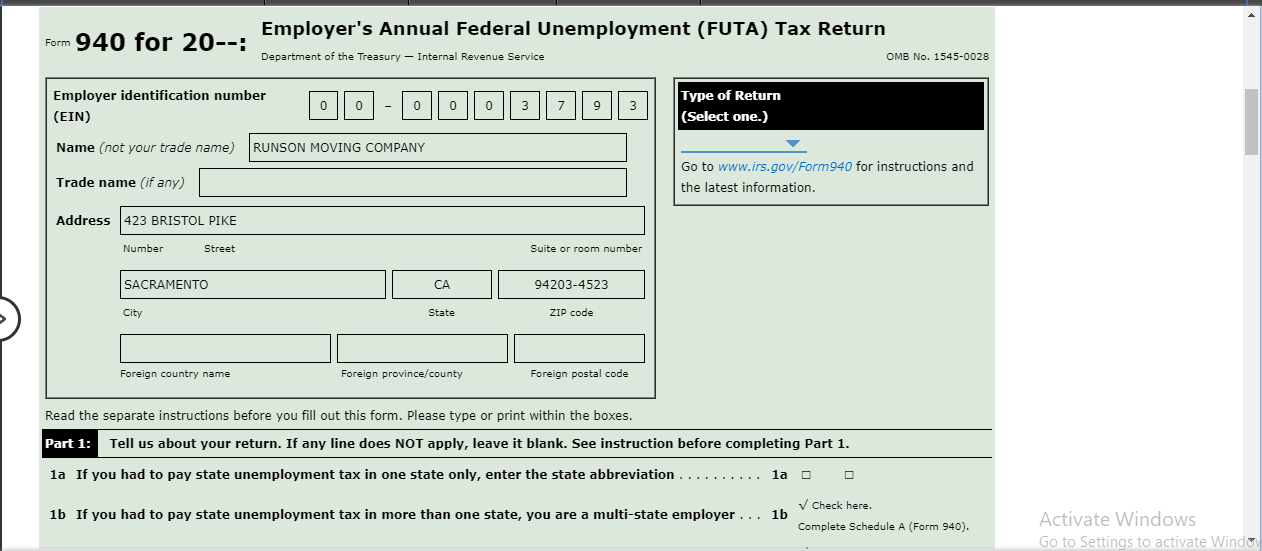

The SUTA tax is the state version of the FUTA tax. The maximum to withhold for each employee is 160160. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy.

SUTA or the The State Unemployment Tax Act SUTA is a payroll tax paid by all employers at the state level. SUTA was established to provide unemployment benefits to displaced workers. The SDI withholding rate is the same for all employees and is calculated annually.

To get exact dates employers have to check their states tax authority. Who pays Suta in California. The taxable wage limit is 145600 for each employee per calendar year.

Employees of the SUI will receive a 73 tax rate for 2020 based on the taxable wage base. The state UI tax rate for new employers known in some states and federally as the standard beginning tax rate also can change from one year to the next. The term SUTA is often used to refer to the employers SUTA rate that is the percent of payroll that is assessed on that particular employer.

Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year. Just as FUTA taxes fund federal unemployment programs SUTA taxes fund your states unemployment insurance program. 1 2022 the unemployment-taxable wage base is to be 7000 the department said on its website.

Click to see full answer. 350 x 3 1050. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

Employer Unemployment Insurance UI Tax UI is paid by the employer. Employers in California will pay no higher than 1 percent of their payroll as SUI taxes for 2020. The new employer SUI tax rate remains at 34 for 2020.

The UI rate schedule and amount of taxable wages are determined annually. California state tax rates are 1 2 4 6 8 93 103 113 and 123. As with almost all state regulations the rules that company.

The new employer SUI tax rate remains at 34 for 2021. Here is how to do your calculation. 5 of 7000 350.

An employer with an SUI tax rate of three continues to be the new employer. SUTA was established to provide unemployment benefits to displaced workers. Californias unemployment tax rates and wage base are not to change in 2022 while the state disability insurance wage base is to rise the state Employment Development Department said Oct.

52 rows SUTA the State Unemployment Tax Act is the state unemployment. The states SUTA wage base is 7000 per employee. In California for example quarterly returns for SUTA and other state payroll taxes are due on April 30th July 31st October 31st and January 31st.

For 2022 as in 2021 unemployment tax rates for. 5 of 7000 350. You have employees with the following annual earnings.

New employers pay 34 for the first two to three yearsCalifornia State Payroll Taxes. However some states Alaska New Jersey and Pennsylvania require that you withhold additional money from employee wages for state unemployment taxes SUTA tax. It is often wrongly called Unemployment Insurance or SUI.

2020 SUI tax rates and taxable wage base. SUTA State Unemployment Tax Act dumping one of the biggest issues facing the Unemployment Insurance UI program is a tax evasion scheme where shell companies are formed and creatively manipulated to obtain low UI tax rates. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees.

The new employer SUI tax rate remains at 34 for 2020. The maximum amount of taxable wages per employee per calendar year is set by statute and is currently. Since your business has no history of laying off employees your SUTA tax rate is 3.

AB 664 - With the passage of AB 664 California became one of the first states in the nation to enact legislation as a result of the federal SUTA Dumping Prevention Act. A new employers rate usually will remain the same for at least the first two or three years. Employers pay up to 62 on the first 7000 in wages paid to each employee in a calendar year.

The 2020 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to include a 15 surcharge. State unemployment tax is a percentage of an employees.

The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

The True Cost Of Hiring An Employee In California Hiring True Cost California

What Is Sui State Unemployment Insurance Tax Ask Gusto

Payroll Taxes Cost Of Hiring An Hourly Worker In California In 2020

Employer S Annual Federal Unemployment Futa Tax Chegg Com

State Unemployment Insurance Sui Overview

California S Unemployment Insurance Debt Could Top 48b Calmatters

What Is Sui State Unemployment Insurance Tax Ask Gusto

I Want To Register For A California Employer Payroll Tax Account Number Youtube

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

How To Update Suta And Ett Rates For California Edd In Qbo Youtube

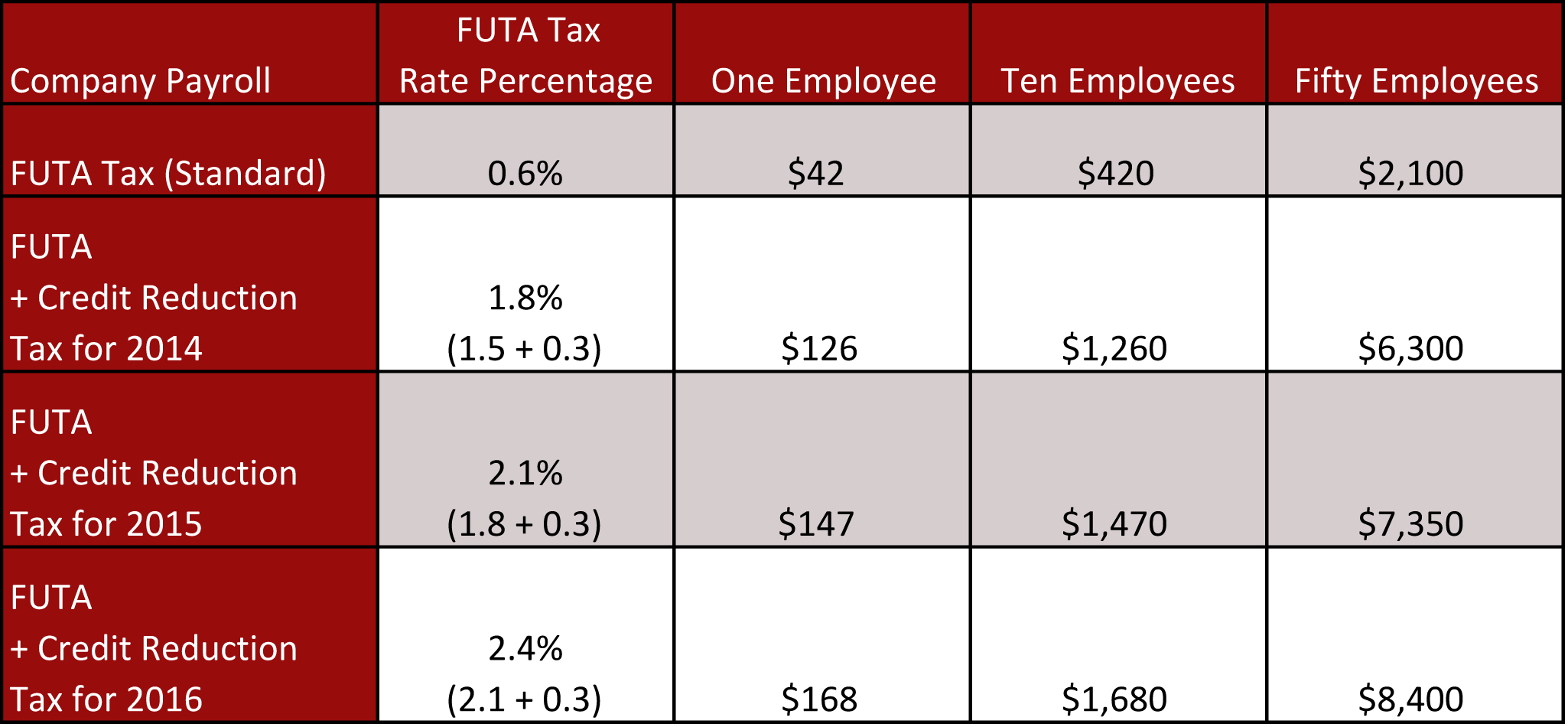

Futa Federal Unemployment Tax Act San Francisco California